|

|

The Effectiveness of Government Policies on Equity and Equality.

Taxation

Progressive Taxation- this is where people on a higher income are taxed at a higher percentage.

In New Zealand there is a progressive taxation system where those on a higher income are taxed at a higher rate.

Top rate: 33% from $70,000

30% - $48,001 to $70,000

17.5% -$14,001 to $48,000

10.5% - $0 to $14,000

The Company taxation rate in NZ is 28%.

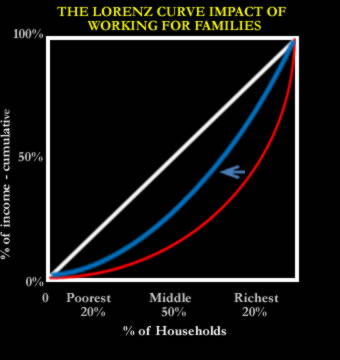

Impact of a Progressive Tax on the Lorenz Curve

|

Equity |

Working For Families

Working for Families is a package designed to help make it easier for low and mid income households to work and raise a family.

Working for Families Tax Credits are made up of four types of payments - family tax credit, in-work tax credit, minimum family tax credit and parental tax credit. Families may qualify for one or more, depending on their personal situation.

A regular adjustment is made to ensure that the Working for Families Tax Credit rates keep up with the Consumers Price Index.

Working for Families Tax Credits increases the income of low to mid income working households with children. To qualify one of the care givers must be working 20 or more hours a week. Money is paid according to the level of income of the household and the number of children.

The tax credit helps families to pay for their childrens needs such as health care, education and better quality food.

Impact of Working For Families.

|

Equity |

Overall Impact of Transfers and Taxation on Equity and Equality.

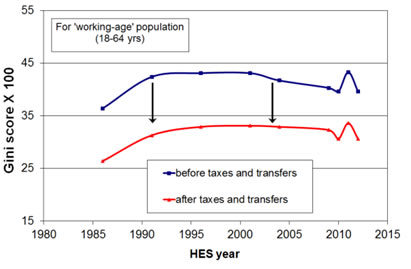

Gini Coefficient For NZ Before and After Taxes and Transfers

|

|

The impact of progressive taxes and transfers such as the working for families tax credit is to cause a fall in the Gini Coefficient and so therefore an increase in equality.

|

The diagram shows that due to a progressive taxation system and transfers 50% of New Zealand Households effectively do not pay any tax. This helps to increase equity by distributing wealth from higher income households to lower income households. |